Money Transfer from India to Singapore

Pay your tuition fees

Pay your university fees easily from your Indian bank account

Send money to an International Bank

Send money to an International Bank

Settle your Rent

Now pay rent to your landlord directly from your account in India

Why Choose Remigos for International Money Transfer?

Save Money With Best Rates

Get 5X superior rates than the market and save money.

No Paperwork, Fully Digital

No need to print out forms or visit banks

Super Fast Transfer

Whether you are sending $100 or $50,000, get in in just 24 hours.

No Hidden Fees

No more gimmicks or getting fooled by banks. Pay what you see.

100% Safe and Secure

Trusted by 1000s. Regulated by RBI. Guaranteed by us.

Hassle-Free Transaction

Super easy to use platform and 24*7 customers support available.

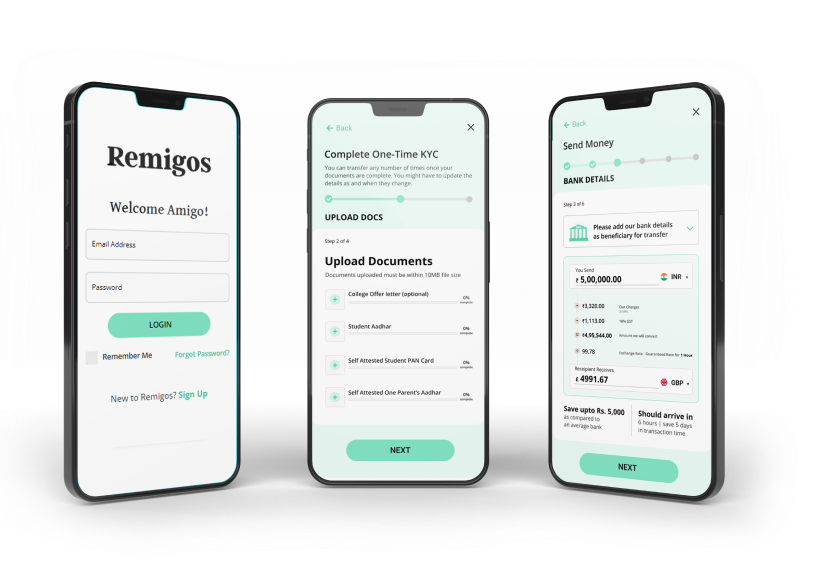

Now Send Money From India to UK From Your Smartphone!

Register in minutes

Sign up online, or on our app with an email address.

Verify your Identity

We’d just need your PAN card, Passport, Visa and College offer letter to verify your identity.

Transfer Money

Fill in the details of your recipient’s bank account and pay using bank transfer.

Track your Transfer

Easily track your transfer on our support. Get real-time updates Whatsapp.

Enjoy Safe and secure Money Transfer with Remigos

RBI Regulated

We are RBI regulated and supported by SBM bank to provide safe and secure money transfer services.

Audited Regularly

Your money is safe with us. We are regularly audited by RBI to safeguard your money.

Covered in Media

It's great to get recognized by London Business School, Indian Startup News and many more for the amazing work we are doing.

Extra-Secure Transactions

At Remigos, no one ever touches your money. You pay it directly to bank and its on the way to its destination.

Data Protection

Your personal data is always encrypted. We are transparent in how we collect and use your information to maintain complete privacy.

Trusted by Indians

Our international money transfer service is used and trusted by 1000s of Indians across the world.

Get The Best International Money Transfer Online Rates with Remigos

5,00,000

5,193.66

1GBP = 95.39 INR

mid-market rate (as on 20th June 2020)

Exchange Rate

95.39

Transfer Fee

₹4576.82

Recipient Gets

5193.66

Exchange Rate

95.39

Transfer Fee

₹8812

Recipient Gets

5149.12

Exchange Rate

97.63

Transfer Fee

₹1000

Recipient Gets

5111.33

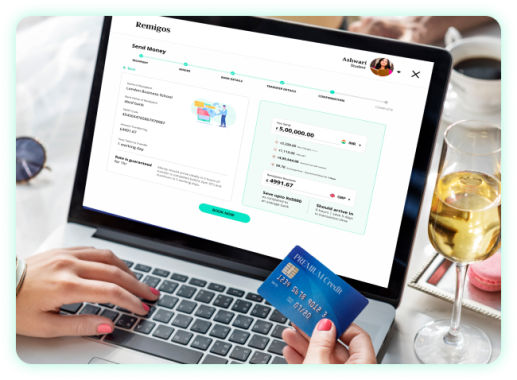

Money Transfer from India to Singapore – At Your Fingertips with Remigos!

Tired of waiting in long queues and paying exorbitant fees to send money abroad? Try Remigos to transfer funds from the comfort of your home and save time, money and hassle!

- Online Money Transfer Process

- Send Money from Your Smartphone

- Transaction Completed in 24 Business Hours

- Money Transfer from India to Singapore At Lowest Rates

- Transparent Pricing and Zero Hidden Fees

100% Safe and Secure Money Transfer to Singapore Via Remigos – Complete Process

Money transfer to Singapore can be a complex process with various fees attached. However, Remigos simplifies it, making it as easy as transferring money locally. If you’re making your first money transfer from India to Singapore with Remigos, follow the steps below:

- Step 1: Register for Free

To use our money transfer service, you must first register for an account. Simply visit our website, click on “Register,” and enter a few details to create your account. The entire process takes only a minute or less.

- Step 2: Verify Your Identity

Verification is a crucial step in money transfer from India to Singapore. After creating your account, you must complete the KYC process to verify your identity. To do so, simply scan and submit a copy of your passport, visa, PAN card, and college offer letter. Once completed, you are good to go.

- Step 3: Add Recipient’s Bank Details

For a money transfer from India to Singapore, you must provide the recipient’s bank details, including the bank name, recipient’s name and address, account number, SWIFT code, IBAN code, and other necessary information.

- Step 4: Add Your Bank Details

Submitting your bank details is a necessary step when sending money through Remigos. In order to initiate a money transfer to Singapore, you need to add your bank details as well.

- Step 5: Pay For Your Transfer

Now, all you need to do is enter the transfer amount and make the payment from your bank account. Remigos will deduct the amount from your account and credit it to the recipient’s account within 24 hours. You can track the money transfer to Singapore in real time while waiting for it to be completed.

Money Transfer from India to Singapore with Remigos

Singapore is a modern, youthful nation that serves as a global business hub. It is a significant Asian business centre, attracting many Indian students who aspire to attend prestigious universities such as NUS and NTU. This increases the need for a reliable money transfer service to help parents easily pay tuition fees.

If you are looking for a money transfer from India to Singapore for educational expenses, Remigos has got you covered! Our fast, digital and affordable international money transfer services beat bank transfers and help you save time, money, and hassle.

Remigos is your one-stop online platform for hassle-free money transfer from India to Singapore in just a few clicks. Our service is not only affordable but also incredibly fast and highly secure, ensuring your peace of mind throughout the entire process.

Despite being a newcomer in the Fintech industry, Remigos surpasses the competition with its exceptional exchange rates and unmatched convenience for money transfer to Singapore.

At Remigos, we prioritize convenience and efficiency at a much lower cost compared to other methods of sending funds from India to Singapore. By using our service, you can save money through our low transfer fees and competitive exchange rates, which means you can send more money with each transaction.

Our user-friendly website is designed to make the transfer process smooth and effortless for you. We also offer a free currency conversion calculator, which can be very useful in avoiding any unforeseen charges for money transfer to Singapore.

Want to try our quick, economical and convenient money transfer service? Register Now!

The Remigos Advantage Over Banks & Other Forex Vendors

- Fully Online Remittance Process

Remigos simplifies the money transfer process by providing a fully digital remittance experience that is fast and effortless. Our platform features live exchange rates and offers a convenient way for money transfer from India to Singapore anytime you desire. There is no need to visit banks or search for other vendors when you have Remigos right at your fingertips.

- Fastest Transfer Processing Times

If you’re looking for an easy, paperless, and secure way to money transfer to Singapore, Remigos is the optimal solution. Whether you need to pay university tuition fees or for any other reason, Remigos guarantees that your funds will reach their intended destination within 24 hours.

- Minimum Transfer Charges

Banks and other money transfer services are often criticized for their high transfer fees, but Remigos customers benefit from minimal transfer charges plus GST when using the platform for money transfer to Singapore. Our transparent pricing policy ensures that we offer the best prices, making Remigos a cost-effective choice for international money transfers.

- 100% Safe and Secure

Remigos differentiates itself from banks and other forex vendors by directly partnering with banks to process your transfer without relying on third parties. This guarantees faster and more efficient processing of your transaction. We are also regulated by the RBI and use the latest encryption technology to ensure complete security for money transfer to Singapore.

- Best Exchange Rates

Frequently asked questions

Yes, Remigos provides more competitive money transfer rates than banks and other remittance providers. While most banks and money transfer services profit by adding a markup to exchange rates, we charge only a minimal exchange fee without any hidden charges. Need proof? Simply check out our currency conversion tool to see a breakdown of the total cost of money transfer from India to Singapore.

When using the Remigos platform, you can enjoy money transfer from India to Singapore for the following purposes,

- Paying Tuition Fees

- Paying Accommodation Rent

- Other Expenses

- Education-Related Expenses

- Cost of Living

Online money transfer to Singapore can be a risky business with the rising threat of cybercrime. But fear not; Remigos has got you covered! We understand the importance of safety and security when it comes to sending money from India to Singapore. That’s why we provide one of the safest ways to transfer funds. Our services are regulated by the RBI, and we use top-notch safety measures such as secure HTTPS connections, encryption, and 2-factor authentication to ensure that all transactions are safe and secure.

Keeping tabs on your transfer status can be a piece of cake with Remigos. Once you’ve sent money from India to Singapore, you can quickly track your transfer right from your smartphone. Just sign in to your account, click on your recent transaction and voila, you can easily monitor the status of your money transfer to Singapore. Plus, you can opt to receive real-time updates via email or WhatsApp.

Certainly! With Remigos, after a money transfer to Singapore, you will receive an online confirmation receipt that includes all transfer details.

With Remigos, you don’t have to worry about submitting a bunch of documents for a money transfer to Singapore. We make it easy by only requiring a few documents for KYC verification, including your Passport, PAN Card, Visa, and College Offer Letter. Once you complete this simple process after creating your account, you can start transferring money at any time.

Under the LRS (Liberalized Remittance Scheme) policy of RBI (Reserve Bank of India), individuals from India are permitted to send up to USD 2,50,000 or its equivalent annually to Singapore.

When you use Remigos to transfer money from India to Singapore, the transaction is typically completed within 24 hours. However, in rare cases, it may take anywhere from 48 to 72 hours for the recipient to receive the money.

Hear what others have said

Other Countries Where You can Send Money

In the News

Supported By